Get Involve Now

Make a Difference Today

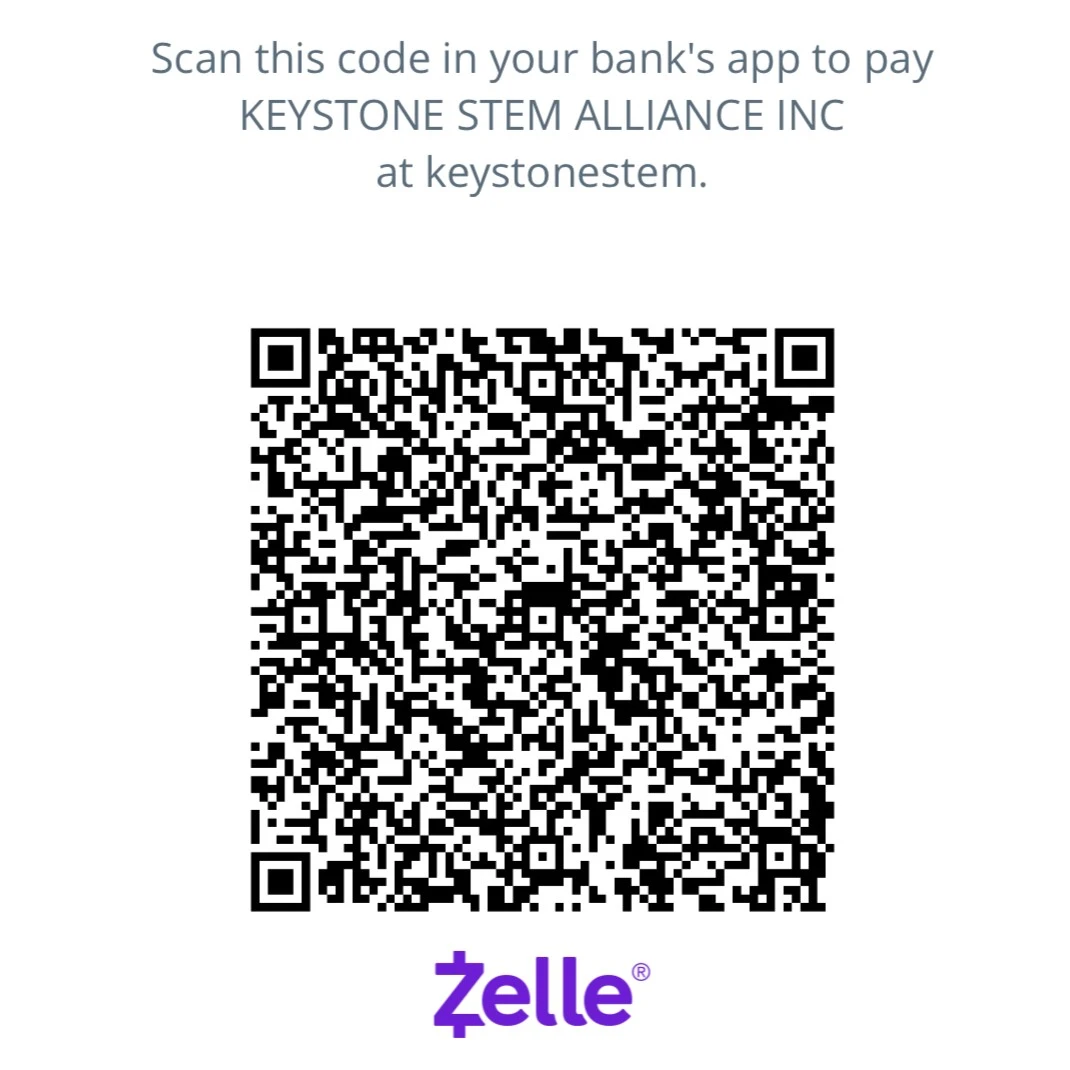

Choose how you want to give

Make a contribution in the way that suits you best, whether online or through employer-supported giving programs.

Choose how you want to give

Make a contribution in the way that suits you best, whether online or through employer-supported giving programs.

_____________________________________________

Give through a donor-advised fund (DAF)

If your Donor-Advised Fund is sponsored by Fidelity, Schwab, or BNY Mellon, use the links below to make a gift to our organization. For all other providers, our EIN is 39-3589749

Donor-Advised Funds Frequently Asked Questions

What Is a Donor-Advised Fund?

A Donor-Advised Fund (DAF) is a charitable giving account that allows individuals, families, and organizations to recommend grants to qualified nonprofit organizations like Keystone STEM Alliance, Inc.

DAFs are commonly administered by organizations such as Fidelity Charitable, Schwab Charitable, and Vanguard Charitable.

How Do Donor-Advised Funds Work?

A Donor-Advised Fund (DAF) is a charitable giving account that allows donors to contribute funds and receive an immediate tax benefit. The donated funds are held and managed by a DAF provider such as Fidelity or Schwab. Donors can later recommend grants from their DAF to qualified nonprofit organizations. The DAF provider then sends the funds directly to the nonprofit to support its mission.

Why Support Keystone STEM Alliance via Donor-Advised Funds

Supporting Keystone STEM Alliance through your Donor-Advised Fund allows you to make a meaningful, tax-efficient impact on STEM education. Your DAF grant helps us deliver hands-on robotics and STEM programs that equip students with critical problem-solving and technical skills. Through mentorship, teamwork, and real-world learning experiences, we inspire students to pursue future careers in science and technology. Your support enables us to expand access to quality STEM education and reach more communities in need.

What is the difference between in the tax recepting process between donating keystone stem alliance via a donor-advised fund versus a direct donation

When you donate through a Donor-Advised Fund, your tax receipt is issued by the DAF provider, not by Keystone STEM Alliance. You receive your tax deduction at the time you contribute funds to your DAF account, even if the grant to Keystone STEM Alliance is made later. When Keystone STEM Alliance receives the DAF grant, it is treated as a charitable grant and no additional tax receipt is issued to the donor.

Can a Donor-Advised Fund be used to donate to a private foundation?

No. In most cases, Donor-Advised Funds cannot be used to make grants to private foundations. DAFs are generally intended to support public charities, such as Keystone STEM Alliance. While some DAF providers may allow limited grants to certain operating foundations, this depends on the provider’s specific guidelines. Donors should check with their DAF provider for more information.

What are the benefits of a Donor-Advised Fund?

Donor-Advised Funds offer an easy and tax-efficient way to support charitable causes. Donors receive an immediate tax deduction when they contribute to their DAF, even if grants are made later. DAFs provide flexibility, allowing donors to support multiple nonprofits over time. They are also convenient to manage and are often used for larger, planned charitable gifts.

Is there an income tax deduction for a Donor-Advised Fund?

Yes. Donors may receive an income tax deduction when they make a contribution to a Donor-Advised Fund, subject to IRS rules and limitations. The tax deduction generally applies in the year the contribution is made to the DAF, even if the funds are granted to a nonprofit at a later date. Donors should consult their tax advisor or DAF provider for details specific to their situation.

Contact & Support

Email hello@keystonestemai.org if you have questions about giving to the Keystone STEM Alliance, non-profit organization through your donor-advised fund.